"mobile payments" entries

Commerce Weekly: Best Buy wants to end showrooming, Google wants to start

Google's stores, Best Buy's online price match, Amazon's retail domination strategies, and Square's Business in a Box.

Google takes on brick-and-mortar; Best Buy takes on ecommerce

The Google retail store rumor ignited again this week. Seth Weintraub reported at 9to5Google that “[a]n extremely reliable source has confirmed to us that Google is in the process of building stand-alone retail stores in the U.S.” to be opened in time for the 2013 holiday season. The Wall Street Journal’s Amir Efrati followed with confirmation from “people familiar with the matter,” though one of those people said it wouldn’t happen this year.

The Google retail store rumor ignited again this week. Seth Weintraub reported at 9to5Google that “[a]n extremely reliable source has confirmed to us that Google is in the process of building stand-alone retail stores in the U.S.” to be opened in time for the 2013 holiday season. The Wall Street Journal’s Amir Efrati followed with confirmation from “people familiar with the matter,” though one of those people said it wouldn’t happen this year.

Across the board, analysts seem to think it’s a good idea. Alyson Shontell at Business Insider noted that as Google becomes more of a hardware company — with its Android devices, Google Glass, and self-driving cars — analysts say it’s time for Google to work on its brand image, which will require consumer interaction, something the company hasn’t done much of up to this point. Google executives seem to agree — Weintraub reported that retail store plans started to solidify along with plans to offer Google Glass to mainstream consumers. “The leadership thought consumers would need to try Google Glass first hand to make a purchase,” Weintraub wrote. “Without being able to use them first hand, few non-techies would be interested in buying Google’s glasses (which will retail from between $500 to $1,000).”

Commerce Weekly: Analytics for people, the next big thing in retail

Retailers tracking Wi-Fi, Payleven's new funding round, Square's success, and NFC's real role in mobile commerce.

Here are a few stories that caught my attention in the commerce space this week.

New trend in retail customer tracking: Smartphone Wi-Fi

Dan Tynan posted a two-part series (here and here) on IT World this week looking at growing trend of retail Wi-Fi tracking — retailers keeping track of you via your smartphone as you shop, much like online retailers keep track of your movements across the Internet. Tynan explains how they’ll do it:

Dan Tynan posted a two-part series (here and here) on IT World this week looking at growing trend of retail Wi-Fi tracking — retailers keeping track of you via your smartphone as you shop, much like online retailers keep track of your movements across the Internet. Tynan explains how they’ll do it:

“When you come within range of a properly configured Wi-Fi access point, it can record the wireless MAC address of your phone — a unique 12-digit number. Every time you pass by, that AP can log that number. … Think of it as Google Analytics for people; instead of measuring Web traffic, they’re measuring foot traffic.”

Tynan takes a look at Euclid Analytics’ software, which works with tracking device systems to help stores gather data on customers, from which aisles they spend time in to how many times they’ve visited the store to which locations they frequent. “[T]hey can even track people who walk by the store every day but never go in,” Tynan writes, “or [know] if more people enter after a window display is changed.” He notes that Euclid gathers data anonymously and in aggregate, storing the MAC address “in a one-way hash, so nobody can go backwards and figure out your actual MAC address,” but that the minute a shopper swipes a credit card, all anonymity is lost, at least as far as connecting a particular phone to a particular purchase.

Once an identity is linked to a MAC address, “all kinds of fun things can happen,” Tynan reports — retailers could text you as you walk by their stores in the mall and offer discounts or coupons to lure you inside, connect your in-store data to your online data for even deeper analysis, or even sell your data to someone else. He explores some of the privacy concerns and scenarios in his first piece and talks with Euclid Analytics director of marketing John Fu for some context in his second piece. Fu says their technology is — purposefully — not as Big Brother as it sounds:

“There are some powerful and potentially scary things you could do with this data if you wanted to, but I want to clarify that we are not doing any of those things. We anticipated these scenarios and came up with ways to prevent them from happening.”

In addition to creating a one-way hash for a customer’s MAC address, Euclid requires retailers to contractually agree “to not combine the behavioral data they collect with information they have about an individual’s identity,” and the company also “salts its data with a ‘statistically insignificant’ number of fictional customers” to further prevent customer identification, Tynan reports. He takes an in-depth look at some real world examples of Euclid’s use in retail locations and their efforts to protect consumer privacy, but also notes that “Euclid is only one of a half dozen companies using different techniques to help retailers track shoppers, most of which don’t bother to tell you.” You can read his complete report at IT World — part one, part two.

Commerce Weekly: PayPal marches toward ubiquity

New PayPal partners, mobile wallet disruption may hinge on Apple, and prioritizing mobile in a "lukewarm" market.

Here are a few stories that caught my attention in the commerce space this week.

PayPal expands its footprint with new partners

PayPal announced this week it has expanded its U.S. footprint to include 23 new partners for its PayPal in-store payments service, in addition to the 15 national partners announced last May, making its service available in 18,000 physical store locations across the country.

PayPal announced this week it has expanded its U.S. footprint to include 23 new partners for its PayPal in-store payments service, in addition to the 15 national partners announced last May, making its service available in 18,000 physical store locations across the country.

According to a post on the PayPal blog, new retail partners include Barnes & Noble, Office Depot, Foot Locker and Jamba Juice, and “two additional partners that [they] will share publicly soon.”

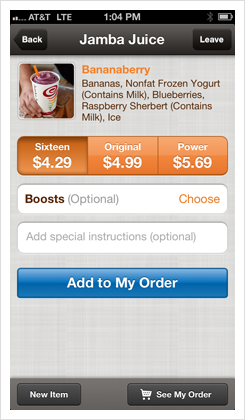

The deal PayPal struck with Jamba Juice goes beyond the in-store payments service that allows customers to pay with their phone number and a pin, or by using their PayPal payment card. Chloe Albanesius reports at PCMag that PayPal is testing its PayPal App in one Jamba Juice location to allow customers to place and pay for their orders, so when they arrive at the location, they just have to pick up their smoothie.

Global product VP Hill Ferguson notes in a post at the PayPal blog, that the feature is available only for iPhone users at this point and that there are plans to expand to more Jamba Juice locations this year.

In addition to its announcement of new retail partners, PayPal also announced a new hardware partner. Sarah Perez reports at TechCrunch that PayPal is “also partnering with point-of-sale and hardware maker NCR to expand into restaurants, as well as into other businesses, including gas stations and convenience stores.”

Commerce Weekly: Gift cards get Square

Square launches gift cards, Cardfree launches mobile payments tools, and Maluuba can now do your shopping.

Here are a few stories that caught my attention in the commerce space this week.

Give a gift through Square

Mobile payment company Square got into the gift card business this week, launching a gift card service tied to its Square Wallet. Christina Chaey reports at Fast Company that Square Wallet users can buy gift cards in amounts from $10 to $1,000 from any of the 200,000-plus businesses that process payments with Square and give them to anyone — recipients do not need to be Square users.

Once a gift card is purchased, it is sent to a recipient’s email inbox. From there, the gift card can be redeemed in a number of ways: for Square users, the card will automatically appear in their Square Wallet; iO6 users can save the card to their Passbook; and for those who don’t use either Square or Passbook, a QR code can be printed out for a merchant to scan.

Given its recent partnership with Starbucks that catapulted Square into the mobile payment mainstream and its international expansion into Canada, gift cards might seem a bit of a departure from the platform’s mobile payment focus. Square CEO Jack Dorsey explained the move in an interview with The Wall Street Journal’s Matthew Lynley. Not only is Square aiming to make the gift card experience cheaper for merchants — Dorsey explained that traditional gift cards can cost merchants 10% to 15% to issue, where Square will charge only the 2.75% they do for credit cards — but it’s also using the cards as a discovery tool and to streamline the experience for consumers. Dorsey said to Lynley:

“The biggest problem merchants have is being remembered and being discovered, so it’s another tool for discovery. If I really like a place and I’m a good friend of yours, I can tell you, but if I give you a gift card, you’re really going to try it out. … It also starts getting into a concept of more remote commerce. People from their couch can send these experiences, can send these gifts, and they don’t need to pick out different things.”

You can read Lynley’s full interview with Dorsey here.

Commerce Weekly: Square’s big moves

Square gets a bigger office, embraces Canada and plans to double its staff. Also, PayPal Here, Isis, Apple and Google Wallet news.

Here are a few stories that caught my attention in the commerce space this week.

Square gets international, plans major growth; PayPal Here hits retail

Square made a couple of big move announcements this week. First, the company literally will move to a new office space in the Central Market area of San Francisco by mid-2013, according to a report by Leena Rao at TechCrunch. Rao notes that the company has grown to more than 400 employees and reports Square plans to expand its staff to almost 1,000 people before the end of 2013.

Square made a couple of big move announcements this week. First, the company literally will move to a new office space in the Central Market area of San Francisco by mid-2013, according to a report by Leena Rao at TechCrunch. Rao notes that the company has grown to more than 400 employees and reports Square plans to expand its staff to almost 1,000 people before the end of 2013.

Square also announced this week that its service is now available in Canada, at the same 2.75% rate it charges in the U.S., according to a report by Ingrid Lunden at TechCrunch. Lunden reports one of the obstacles for Square in Canadian as well as European markets is that its dongle depends on the magnetic stripe on the backs of credit cards; many credit card processes in these markets use a chip-and-pin system instead.

The obstacle isn’t insurmountable, however, as Lunden notes, Square’s partnership with Starbucks to incorporate its Pay With Square app service as a mode of payment might pave the way forward with retailers in other markets, making the card processing format irrelevant.

Square competitor PayPal Here was on the move this week as well — into retail shopping. Rao reports in a separate post at TechCrunch that PayPal CEO John Donahoe announced a U.S. retail deal with AT&T during eBay’s earning call this week. PayPal Here previously had a retail presence only in Japan with Softbank. Rao reports that Here will retail for $15, with the purchaser receiving a $15 discount upon signing up; Square is sold in 20,000 outlets in the U.S. and sells for $10, with a $10 purchaser sign-up discount, Rao reports.

Commerce Weekly: Apple excludes NFC, leaves payment pioneering to others

No NFC for iPhone 5 but it still might solve a problem. Plus a look at the mobile payment quagmire.

Here are a few stories that caught my attention in the commerce space this week.

So that’s that: No NFC for the iPhone 5

Leading up to yesterday’s Apple event, there was much rumor mongering over whether or not the iPhone 5 would include NFC technology. The rumors have now been resolved: Apple did not include NFC in the iPhone 5. All Things Digital’s Ina Fried talked with Apple’s Phil Schiller about the lacking technology:

Leading up to yesterday’s Apple event, there was much rumor mongering over whether or not the iPhone 5 would include NFC technology. The rumors have now been resolved: Apple did not include NFC in the iPhone 5. All Things Digital’s Ina Fried talked with Apple’s Phil Schiller about the lacking technology:

“Apple Senior VP Phil Schiller said that Passbook alone does what most customers want and works without existing merchant payment systems. It’s not clear that NFC is the solution to any current problem, Schiller said. ‘Passbook does the kinds of things customers need today’.”

Schiller’s sentiments echoed those made by Square COO Keith Rabois last year, that NFC is “a technology in search of a value proposition.” Cotton Delo at AdAge reported on Apple’s decision to forego NFC and side step the mobile wallet arena and noted that it’s not likely to have any ill effects on the mobile shopping ecosystem, as there is plenty of competition in the space to advance mobile wallet technology.

All the same, advancement in technology doesn’t necessarily translate into ubiquitous adoption, and the decision not to include the technology could have ramifications beyond mobile payments. Ryan Kim at GigaOm argues that Apple’s “snub” was a big detriment for NFC, that including it on “the most popular phone” would have educated consumers and brought a level of validation the technology hasn’t yet experienced. Kim also highlights the bigger issue:

“NFC is much more than just payments and can facilitate personal media and information sharing, building access, marketing and easy Bluetooth pairing. Google, BlackBerry, Nokia and Samsung have all shown different ways in which NFC can be used. But without many common applications that can work between those devices, there’s fewer chances for people to really adopt the technology. With a new iPhone likely to be a best seller, there would have been a lot of ways for people to get acquainted with NFC-actions. Now, the promise of NFC will still struggle to be fulfilled for at least another year.”

Commerce Weekly: U.S. merchants take on mobile payment

U.S. retailers launch a mobile payments network, tech is driving the future of shopping, and East vs West Coast shopping stereotypes.

Merchants enter mobile payment arena

With mobile payments on the brink of booming, everyone is angling to get in the game, from payment companies like PayPal and Square to mobile carrier ventures like Isis and Vodaphone to Internet giants like Google. This week, a group of U.S. retailers announced they were taking payment matters into their own hands and planning a joint merchant mobile payments network called Merchant Customer Exchange (MCX). And there are some big players involved.

With mobile payments on the brink of booming, everyone is angling to get in the game, from payment companies like PayPal and Square to mobile carrier ventures like Isis and Vodaphone to Internet giants like Google. This week, a group of U.S. retailers announced they were taking payment matters into their own hands and planning a joint merchant mobile payments network called Merchant Customer Exchange (MCX). And there are some big players involved.

Robin Sidel at The Wall Street Journal reports that 14 merchants have signed on so far, including Wal-Mart, Target, Best Buy, 7-Eleven, and Lowe’s. Wal-Mart corporate VP and assistant treasurer told Sidel, “We’re open to all partners, but it has to be beneficial to member merchants in a way that improves the system and doesn’t layer on additional costs.”

Saving money appears to be one major motivator behind the new network. Ryan Kim at GigaOm asserts that member merchants are setting themselves up to save money in multiple ways. He writes:

By banding together, they may be able to get better interchange fees from the credit card networks. And in a mobile wallet, they may be able to steer consumers to use their own issued cards or prepaid gift cards. And if an issued card is pulling funds directly from a bank account, they can avoid card fees. You might see retailers offer deals on the spot for consumers who fund a purchase using their bank account through their mobile wallet.

Kim also notes that by launching their own system, the retailers will retain control over their own data and keep it out of third-party hands, pointing out that “Google, for example, is trying to get at the purchase data through Google Wallet.”

No launch date has yet been set for MCX, and Sidel reports that the search for a CEO is underway.

Commerce Weekly: Identifying real-time consumer intent

Startups tap realtime marketing, NFC in the U.K.'s post office, and banks need to remain "top of wallet."

An ecommerce startup aims to understand real-time consumer intent, a 350-year-old post office embraces mobile, and mobile wallets could disrupt brick-and-mortar banks. (Commerce Weekly is produced as part of a partnership between O'Reilly and PayPal.)

Commerce Weekly: Bump taps mobile payments

Bump gets powered by PayPal and the payments world waits for Apple.

Bump enlists PayPal's help in tapping mobile payments. Also, a columnist wonders when Apple will save the mobile payment space. (Commerce Weekly is produced as part of a partnership between O'Reilly and PayPal.)

Commerce Weekly: The do’s and don’ts of geo marketing

The evolution of geofences, Google Wallet's departures, and mobile carriers vs Facebook.

Placecast's CEO describes layers of context that make for rich, geo-targeted messages. Also, talent flees Google Wallet, and Facebook's IPO may make life harder for mobile carriers. (Commerce Weekly is produced as part of a partnership between O'Reilly and PayPal.)