Here’s what caught my eye in commerce news this week.

Daily Show corners gaming CEO on freemium

Poor Rizwan Virk. The co-founder and CEO of GameView Studios thought he was going to be featured as a new media visionary whose product (social games) contribute to a thriving virtual economy while the real one staggers on through an endless, grinding downturn. Instead, he found himself being skewered by Daily Show correspondent Aasif Mandvi, who accused him of playing off children’s emotional immaturity and propagating a business model that looked a lot like drug dealing. Fame, like the Daily Show’s producers, plays by its own rules. Here’s the segment:

The sneak attack on Virk centered around GameView’s popular TapFish, which features a virtual aquarium where players feed virtual food to virtual fish. The game is free, but as with all freemium games, a small percentage of players choose to buy virtual goods (food, fish, accessories) to enhance it. Virk touted the model in the interview as a new approach that allows more people to play the game: “Traditionally, you had to go to a store and buy a $60 cartridge to play. In this new model, you can play games for free.”

Mandvi then switched gears and reported on a family in Montpelier, Vermont, (though it’s unclear whether this was a real family or actors) where the kids boasted about maxing out the dad’s credit card buying virtual fish and fish food on an iTunes account. B-roll showed someone purchasing $99.99 of virtual fish — though Virk says most of the game’s actual purchases are for less than $2.

Virk looked equal parts annoyed and confused as Mandvi accused him of pushing a model that lured people into the game and then exploited their addiction. “You provide a product, the first one is free,” Mandvi said. “And then as they get accustomed to your product, the price rises. So you’re a drug dealer.” He then went on to accuse Virk of targeting kids as the dupes, exploiting their “undeveloped frontal cortex” and their desire to keep the fish alive at any cost.

Virk defended himself in

a blog post the next day, saying he felt tricked because the Daily Show said it was producing a segment on the virtual goods, and Mandvi’s “drug dealer” comments came near the end of four hours of recording. In the post, he pointed out that most purchases are for much less than the one shown during the interview and that all purchases require the buyer to enter their iTunes password. But of course, far fewer people will read his post than see the Daily Show bit.

The report was an unusual attack on the increasingly popular freemium model, which, as Flurry Analytics pointed out last summer, has become the dominant model for popular mobile games. Stories of kids overspending appear rare and anecdotal. I took a small survey on Facebook and Twitter for this post, asking parents how many of them shared their iTunes password with their kids. For the most part, that trust barrier seemed to break down along age lines, with parents of kids younger than about 8 or 9 not sharing the password, while parents of teens were more comfortable with sharing — especially if, as in one case, the child had set it up for them. That may be because at a certain age, kids are old enough to understand they’re spending real money and that they’re likely to lose the privilege if they abuse it. At least that’s what happened to one of the kids in my mini poll: “[I shared the password] until he purchased a bunch of music with inappropriate content!”

X.commerce harnesses the technologies of eBay, PayPal and Magento to create the first end-to-end multi-channel commerce technology platform. Our vision is to enable merchants of every size, service providers and developers to thrive in a marketplace where in-store, online, mobile and social selling are all mission critical to business success. Learn more at x.com.

X.commerce harnesses the technologies of eBay, PayPal and Magento to create the first end-to-end multi-channel commerce technology platform. Our vision is to enable merchants of every size, service providers and developers to thrive in a marketplace where in-store, online, mobile and social selling are all mission critical to business success. Learn more at x.com.Isis taps NFC partner

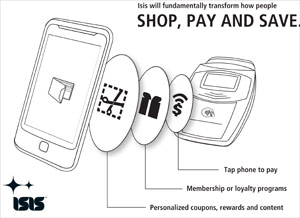

Isis, the mobile payment platform funded by Verizon, AT&T, and T-Mobile, said it has contracted with Dutch digital security company Gemalto to run the NFC platform on Isis-enabled phones. This means that Gemalto will manage the access to the secure NFC chip on Isis-enabled phones, saying in effect who can access the system for payment or other services.

Isis, the mobile payment platform funded by Verizon, AT&T, and T-Mobile, said it has contracted with Dutch digital security company Gemalto to run the NFC platform on Isis-enabled phones. This means that Gemalto will manage the access to the secure NFC chip on Isis-enabled phones, saying in effect who can access the system for payment or other services.

The move is another step toward Isis’ eventual rollout, which will be preceded by two tests planned for the first half of 2012 in Austin, Texas, and Salt Lake City, Utah. Isis is emerging as a major competitor to Google Wallet, particularly in light of Verizon’s recent decision not to allow Google Wallet to function on the Android-powered Samsung Galaxy Nexus on Verizon’s network. Verizon and Google say they’re in discussions, but skeptics wondered if this might be the first of many blocks to come by the three carriers who support Isis.

Meanwhile, Bank Technology News (BTN) reported that Google Wallet may be planning to roll out a larger demo in London in the first months of 2012, ahead of the Summer Olympics. BTN said that Visa, the payments sponsor of the Olympics, is likely to be part of that trial. Thus far, Google Wallet has been limited only to Nexus owners on the Sprint network who have a MasterCard through Citibank. The London trial is likely to be widespread, reaching more handset owners and, presumably, far more merchants.

Consumers: Make it easier for us to spend

Survey results released this week offer the counter-intuitive finding that consumers might be more comfortable with mobile payments than they are with credit cards. Javelin Strategy & Research conducted the survey that found that (not surprisingly) consumers don’t like having to key in 16-digit credit card numbers to buy stuff online. They would be more comfortable with direct carrier-billed mobile payment, which requires only a mobile number and a pin. Those charges then show up on a mobile carrier bill. The survey was commissioned by Payment One — a direct carrier-billed mobile payment provider.

More than half of the 2,000 consumers who took the survey said they’ve abandoned shopping carts before checking out because of security concerns, and four out of five said they would spend more money online if it were easier and more secure. In the report, Javelin said this could all add up to an additional $110 billion in new revenue for merchants in the U.S. each year. Payment One is just one of several vendors willing to step in to help merchants reach that number, recognizing that 14 numbers is a lot easier to key in than 16, particularly when 10 of those digits are your mobile phone number.

Got news?

News tips and suggestions are always welcome, so please send them along.

If you’re interested in learning more about the commerce space, check out DevZone on x.com, a collaboration between O’Reilly and X.commerce.

Related: