Here’s what caught my attention in the payment space this week.

3 levels of awareness about geolocation

Before last week, many mobile users likely weren’t thinking about their location data; that’s changed for some. Apple, while maintaining that it hasn’t been tracking users, promises to change the way location data is stored and transmitted on its mobile devices. But even as Apple’s problem dissipates, the discussion has put the issue of location on the radar screen, and reporters and bloggers are digging into what it means.

Before last week, many mobile users likely weren’t thinking about their location data; that’s changed for some. Apple, while maintaining that it hasn’t been tracking users, promises to change the way location data is stored and transmitted on its mobile devices. But even as Apple’s problem dissipates, the discussion has put the issue of location on the radar screen, and reporters and bloggers are digging into what it means.

Watching the discussion over the past week, I’ve come to think there are three levels of awareness that mobile users have about location data. The first is simple awareness, the understanding that your cell phone and the network it’s connected to have to know where you are. The second level is a sort of bargaining that comes from that realization, the idea that you should be getting something back from this data or from the people who store it. And the third level, more proactive still, is that you yourself should have access to this data so that you can do something constructive with it.

Regarding awareness, it may have been an eye opener to insiders that so many consumers weren’t aware their cell phones were tracking their movements. A report on NBC’s “Today” show began with the line, “It sounds like something out of science fiction: a phone that tracks your every movement.” Of course, long before smart phones with maps and check-in services, cell phones had to communicate with nearby cell towers in order to obtain service. GPS and Wi-Fi data have made the pinpointing more precise. But somehow the knowledge that Google Maps on your iPhone can place you at a certain point on the road and show your progress as your bus moves up the street didn’t translate, for some people, to an understanding that the phone and your wireless carrier must know where you are and are able to keep a record of it. That’s been made clear to a much larger audience now.

In the wake of this understanding, some reporters and bloggers took up the consumer angle, wondering what we get back for giving up this data. This is an excellent point and one on which, I believe, the future of mobile commerce rests. The communication of data must be a two-way street where each party benefits. I give the navigation service my location and pace and, in turn (and for free) it repays me by displaying traffic data for any major city in 70 countries. I tell Foursquare where I’m checking in and it rewards me with information on where my friends have most recently checked in (and perhaps with a few meaningless points and badges, too). I tell Shopkick I’m near the big box stores in town and it sends me coupons for cleaning products. As mobile and location become more integral to purchases, the connection between my giving up location in exchange for another’s profit will become more clear — and consumers will get more vocal about negotiating it.

The promise was also floated that, in the hands of the right folks, this data could be analyzed to gain deep social, political, and medical insights. Robert Lee Hotz’s excellent article in Wednesday’s Wall Street Journal (in front of the paywall) described several academic research efforts exploring how much they can learn from smart phones. Researchers are seeing what they can learn by not only tracking movements, but when equipped with apps that help users record eating habits, social interactions, moves, and gestures, they claim to be learning how political and social opinion are shaped and how users are influenced to make decisions. The marketing implications of this are obvious — that’s the other edge of this sword — and Hotz notes that telecom carriers may already be using this data to assess who is most at risk for switching their contract to another phone company.

Some people have taken the case to the third level (being proactive about personal data) and suggest that consumers should be able to access their data, either to see what it tells us about ourselves or to do something else with it. Richard Thaler in The New York Times proposes that wireless carriers make a version of your geolocation data available for your use, so that you could either analyze it or port it to a third party who could. One could argue that this is essentially what Apple got called out for doing, albeit without telling anyone, but Thaler’s point is still valid. He cites a simple example of being able to analyze your phone usage for a better plan, though this is a service some carriers already offer if you call them up and ask.

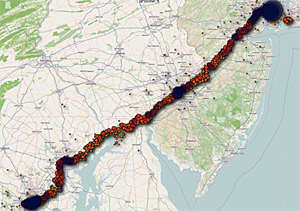

While it’s easy to see what merchants and other third parties can provide of value in exchange for your location data (coupons, deals, reviews, directions), we’ve just begun to explore what we might be able to discover that’s greater than a discount. As we’ve learned, once you provide the dataset, people do amazing things with it. In his follow-up post a week after noting the iPhone tracking details, Pete Warden points to one such use: Maria Scileppi’s Living Brushstrokes project, which uses location tracking to create artistic views of people’s movements.

And the payment deals keep coming

Returning to the nitty-gritty of the payments world … Facebook and Google jumped into the daily coupon business over the past week. Google Offers is promising a debut in Portland soon (the same place Google first tested Hotpot, which was recently folded into Google Places) and Facebook Deals rolled out in five cities. The moves may remind you of the ways both of these companies jumped into the check-in business last fall after seeing the successful uptake of check-ins via Foursquare, Yelp, and Gowalla.

Returning to the nitty-gritty of the payments world … Facebook and Google jumped into the daily coupon business over the past week. Google Offers is promising a debut in Portland soon (the same place Google first tested Hotpot, which was recently folded into Google Places) and Facebook Deals rolled out in five cities. The moves may remind you of the ways both of these companies jumped into the check-in business last fall after seeing the successful uptake of check-ins via Foursquare, Yelp, and Gowalla.

Groupon said it didn’t need Google’s $6 billion last November, so Google’s coming after them. Sharise Cruze on BusinessReviewUSA reported that <a href="Google will display its offers on maps, so don’t be surprised if the Offers service (like Hotpot before it) gets folded into Places.

Mobile banking 2.0

Bank of America said it’s embarking on a series of changes to revise its mobile banking. Writing in American Banker, Andrew Johnson noted that the move is a reminder that early adopters are into a second wave of refinement, applying what they’ve learned in the first few years of mobile banking to the next wave. Bank of America, Chase, and Wells Fargo are the top three mobile banking apps in the US, according to a report published in InvestingAnswers.com. Still, there’s a lot of room for growth: comScore’s annual online credit card report finds that 20% of mobile phone cardholders use their phone to access a bank account, and 13% are doing that via a mobile app. Since mobile and online are a far cheaper way for banks to manage their customers, we can be sure they’ll be at work revising the apps to make them easier to use, more appealing, and more capable.

Got news?

News tips and suggestions are always welcome, so please send them along.

If you’re interested in learning more about the payment development space, check out PayPal X DevZone, a collaboration between O’Reilly and PayPal.

Related: